Disclaimer: As an Amazon Associate, “Furniture UK” earns from qualifying purchases.

A new headache for retailers came with the Conservative regime budget of July 2015. The Chancellor of the Exchequer came with an announcement that those above the age of 25 will, beginning April 2016, start receiving a “Living Wage”. The Chancellor defined it as £7.20/hour in 2016 but expected it to rise to around £9/hour in four years.

The national minimum Wage by 2015 stood at £6.50/hour, meaning that within the Living Wage’s first year, the employees receiving the lowest pay rate would see a wage increase of 10.8 percent. In contrast with the minimum Wage of 2015, the government had indicated its decision that by 2020 those over 25 years of age should see a 38.5 percent increase in their pay.

Welcomed idea

Of course, enhancing people’s living standards with better pay is always welcome. The 2016 first increment might not have a massive effect across the retail world, and those under 25 will not be benefiting from the rise just yet and will be taking home the minimum Wage as before. However, as years go by, the introduced Living Wage is expected to have unintended repercussions, especially across the retail sector regarding remuneration, staff hours, job numbers and the number of stores. Essentially, the Living Wage has consequences for retail stores, including national insurance and pension payments.

Living wage rationale

The retail sector employs around 3 million workers, with many on short-term contracts and others part-time. All are paid the minimum Wage and sometimes something a little bit more. Nonetheless, in 2015 the average median hourly pay rate in retail stood at £7.30/hour, meaning that a significant number of workers in retail are taking home more than the national minimum Wage. This group hasn’t been affected by the announcement.

Those above the age of 25 working in retail are a third of the entire working population in the retail sector. Most of them work in fashion, discount stores and supermarkets. It means many workers in this sector are very young to enjoy the introduced living wage. Across the UK, mainly in retail, lots of poorly paid workers get welfare benefits courtesy of the government to boost their income and to be able to pay their taxes as required by the state. With the new Budget, the Chancellor of the Exchequer seeks to cut payments directed to welfare. During the 2015 Budget, the Chancellor indicated that with the new Living Wage, it’d be clear that work does pay and that people can live off their work and not from government subsidies.

Reduced corporate Tax

To boost businesses, the Chancellor had the Corporate Tax reduced to 19 percent from 20 percent starting in 2017 and 18 percent by 2020. This would have reduced the tTaxtax that retailers pay. However, for retailers will make very little profit or make very little, enjoying the benefits of a reduced tax wouldn’t be possible.

The Budget Statement of 2015 indicates that the government is aware that the introduced Living Wage will raise the costs of various businesses. This includes those industries where price wars are already affecting profits, like the grocery industry. If these sectors require increased employees, the Living Wage would negatively affect them.

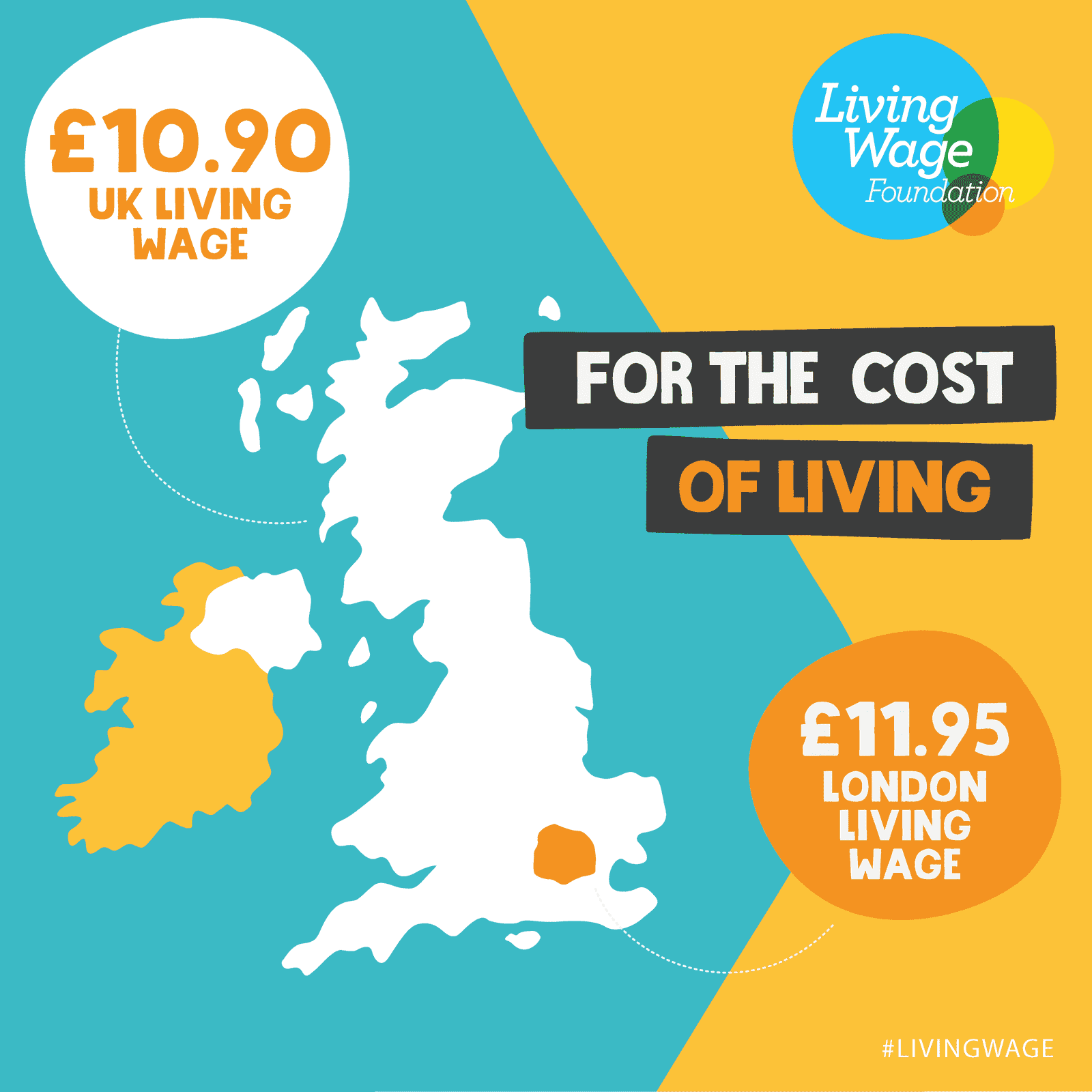

What’s the actual Living Wage?

Essentially, the actual Living Wage, as calculated by the Centre for Research in Social Policy of Loughborough University, is set as per the cost of living indicators, although it lacks legal backing. While it lacks legal authority, it shows the minimum a person is required to live without debt across the United Kingdom. The Social Policy’s calculated Living Wage for 2015 stands at £7.85/hour across the nation and around £9.15/hour in London. Of course, the Living Wage is above what the Chancellor proposed in his Living Wage, who didn’t indicate or recommend a higher allowance in the English capital.

Living Wage impact

According to the Office for Budget Authority, the estimate of jobs to be lost in virtually all the sectors in the entire economy is about 60,000. Nonetheless, the authority has claimed the Living Wage is difficult to forecast. This means that the impact will be far-reaching in various ways.

Firstly, it means the price will increase as a retailer is obliged to increase the pay rates. With a rise in labour costs, retailers have no choice but to pass the cost to customers by raising prices. Thus, the cost of doing business for retailers will go up to around £3,260.48 million by 2020-2021. While passing the cost to consumers will happen, it’ll not be possible in all the sectors and areas of the economy.

Labour will have to reduce as fewer staff will be employed as retailers cut the hours staff are used to and refuse to replace team members who’ve left. At the same time, delivery charges to homes will go up, and free deliveries will only be possible for big purchases and high-value checkouts.

The number of stores is also expected to drop by 14,000 in 2020 as the cost of labour would have accelerated the fall. In addition, customers will probably see lots of new technology in retail as self-scanning and self-service technology will be used more, replacing human capital.

![Report on the British educational furniture manufacturers group [BEFMG]](https://thehome.co.uk/wp-content/uploads/2018/02/report-furniture-uk.jpg)