Disclaimer: As an Amazon Associate, “Furniture UK” earns from qualifying purchases.

Like every sector of our economy, the furniture industry has been facing uncertainties about the vote to exit the European Union on June 23rd in the UK. The prices of raw materials critical in the British furniture industry have also changed. It’s expected that the prices might go up by 8-12 percent as the raw materials cost goes up if the Association of the British Furniture Manufacturers is anything to go by.

It’s worth noting that no matter what side of the Brexit divide you were on, about 55 percent of the United Kingdom’s imports are from the European Union.

Strong reaction to fluctuations

The association has indicated a strong reaction within the supply chain of furniture in the UK due to the fluctuations of the sterling pound. The pound dipped by 12 percent against the US Dollar and 8 percent to the Euro in June when the Brexit vote was about to happen. In 2015, around the same time, the sterling pound was above the Euro and dollar by 16 percent.

The cost could go up

As the Euro/Dollar remains stronger than the pound, the cost is expected to go up substantially. Many elements within the furniture industry have indicated that they might be increasing the cost of their products by 8-12 percent to cater to the increase in raw materials. Nonetheless, the British Furniture Manufacturers claim to understand the uncertainties and upheavals in the industry and will do as much as they can to offer support. According to the association, most of the materials used in the furniture industry in the UK are sourced from around the world.

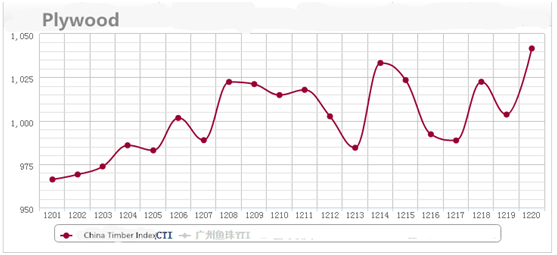

The association has used its cost-tracking system and analysed a variety of 37 feedstocks or materials, essentially determining the costs generally given to every furniture manufacturer. With each commodity the association looked into, spanning the referendum vote period, the prices were contrasted over a year and month. As a result, the association found that most of the monthly changes in cost appeared the same for various items, reflecting the dipping of the Sterling pound against major world currencies. The data indicates over 12 months, the cost of feedstock/raw materials has been going up noticeably. Some of the materials looked into by the association of the British Furniture Manufacturer included hides, boards of diverse compositions, steel wire meshes, foam chemicals, softwoods and hardwoods, and fibres.

Three-and-half-year business confidence low

According to the association’s State of Trade of June 2016, the furniture manufacturers’ business confidence had dipped considerably before the vote to leave the EU was cast. The industry remained pessimistic concerning the future, which is the lowest in the last 42 months. The intake of new orders and output has not been going towards the right direction.

Considering that the association’s survey was taken before the vote, a lot is expected to change. A quarter of all the manufacturers surveyed indicated their belief that the cost of raw materials would go up all summer and in autumn. Of course, the pessimism is real, with the cost of raw materials increasing by 8-12 percent. The fluctuating exchange rate has been hard-hitting for furniture manufacturers as the cost in Sterling Pounds of raw materials such as TDI and Polyol Flexible or Foam increased by 7 percent. The pound was exchanged in Euros between June 22nd and June 29th 2016.

On a brighter note, however, the Financial Survey Ratios by the British manufacturers association indicated that even with its challenges, 2015-2016 was a very successful year in terms of profits. Of all furniture manufacturers, only 5 percent made losses.

Glaring uncertainties

At about the same time the referendum vote was cast and results given, virtually all sectors were affected. Many Britons even contemplated working abroad and making huge purchases of non-food items, including homes on ice. The financial markets triggered panic that followed the Brexit vote rippled down across all areas of decision-making in Britain. Consumers were bracing themselves and preparing for a long and sustained uncertainty.

Most shoppers h d relegated to a survival mode lifestyle after the vote. According to Retail Economics, after the Brexit vote, many people surveyed planned to cut back on expensive purchases from furniture, bathrooms, and TVs to holidays. They waited to see what would happen while expecting the worst financial struggles in the coming years.

While Store sales went up in June and online sales of non-food products went down in the same month due to the Brexit campaigns and the vote’s aftermath, July figures show that most of the pessimism had dissipated. People had returned to their spending ways, albeit with an eye on the future, waiting for Britain’s exit from London to be complete and to see what would happen afterwards.

![Report on the British educational furniture manufacturers group [BEFMG]](https://thehome.co.uk/wp-content/uploads/2018/02/report-furniture-uk.jpg)